Yukon Cornelius said:

lol nah

Friendly wager? Already got one going with another crypto expert on this thread.

Yukon Cornelius said:

lol nah

@NFLPlayerProps said:Yukon Cornelius said:

lol nah

Friendly wager? Already got one going with another crypto expert on this thread.

@NFLPlayerProps said:

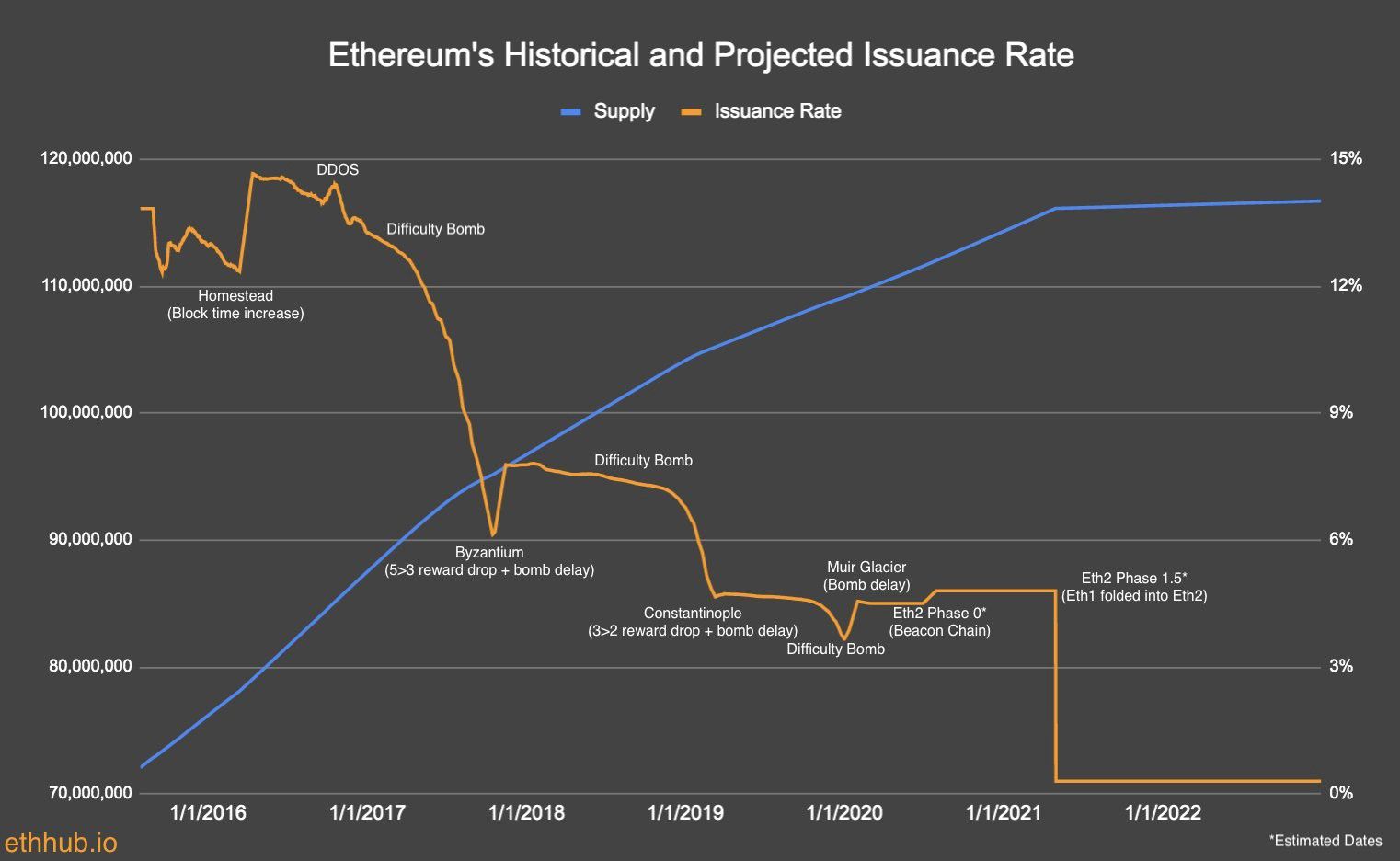

ETH is a ****coin. Google "ETH supply issuance schedule" and see if you can make sense of it

flashplayer said:Heineken-Ashi said:@NFLPlayerProps said:Heineken-Ashi said:

Hope yall got out of MSTR and all of its products.

I did, but this feels like a bottom (assuming BTC can hold). They just raised ~2 years of preferred payments in one week

It's not. But good luck.

Sorry if it's not that far back in the thread but what are you looking at? $50,000?

flashplayer said:Heineken-Ashi said:@NFLPlayerProps said:Heineken-Ashi said:

Hope yall got out of MSTR and all of its products.

I did, but this feels like a bottom (assuming BTC can hold). They just raised ~2 years of preferred payments in one week

It's not. But good luck.

Sorry if it's not that far back in the thread but what are you looking at? $50,000?

jamey said:

crypto flying high today

carl spacklers hat said:

What's your timeline? This week? YE? Just curious.

@NFLPlayerProps said:

ETH is a ****coin. Google "ETH supply issuance schedule" and see if you can make sense of it

TxAG#2011 said:

According to Cointracker there is no wash sale rule so you are allowed to sell "coin A" and then immediately rebuy and it still comes off as a tax loss

jamey said:

Anyone got thoughts on Hedara / HBAR USD?

I see they've got an ETF in HBR

Yukon Cornelius said:

To me the bigger picture is about securing the network in the future vs monetary policy. The btc position is limited supply and the network is secured by future speculative price of btc. The danger is if the price doesn't always go up the network is in danger of losing miners and thus security.

So the opposite approach is to have no limit to always be able to incentivize security of the network. In eths case high price actually works against it as people unstake and sell.

So it's an interesting debate to me.

jamey said:Yukon Cornelius said:

To me the bigger picture is about securing the network in the future vs monetary policy. The btc position is limited supply and the network is secured by future speculative price of btc. The danger is if the price doesn't always go up the network is in danger of losing miners and thus security.

So the opposite approach is to have no limit to always be able to incentivize security of the network. In eths case high price actually works against it as people unstake and sell.

So it's an interesting debate to me.

What do you think about these projections with ETH going to 6K, 12K...even Tom Lee has said 60K

At what point is the price prohibitive to the function whether its thru gas price or people unstaking