One option

What's the safest asset to hold in a Roth IRA for 25 years?

6,255 Views |

42 Replies |

Last: 2 yr ago by $30,000 Millionaire

Safest? Treasuries.

You don’t trade for money, you trade for freedom.

Gold has kept up with the S&P 500 for the last 25 years and is no one else's liability, a very important aspect in the silly world ahead.

jagvocate said:

Gold has kept up with the S&P 500 for the last 25 years and is no one else's liability, a very important aspect in the silly world ahead.

Source? I don't care to look it up and do a research project just to prove you wrong. But since you made the claim I would like to see the work done. And don't just take s&p value from 25 years ago and what it is today, please factor in reinvesting the dividends.

Can we also factor in all of the companies that were in the s&p 500 that went bankrupt or were taken out to be replaced with better companies? Same with any historical index. Would love to see some research on this topic that is very rarely discussed when mentioning historical indexes.

Pretty sure if you held an index funds for the last 25 years it would take that into account for you. I would never suggest someone trying to balance holding all 500 companies on their own

Prove to me you and anyone else would never choose dividend distributions over 2+ decades and I'll think about doing the homework.permabull said:jagvocate said:

please factor in reinvesting the dividends.

U. S. debt obligations are safest...also a good way to get behind. Not for me in a retirement account.

Cool if we can make wild ass claims with out supporting our case I say buy Bernie babies. Beats the s&p, gold and real estate over the last 25 years. Prove me wrong.

I took a gander. Here is the S&P500 chart showing that it was at $1,226.27 in December of 1998. Divide the current market price of $4,505.42 by this number and you can see that we've had a 3.67X increase in the S&P 500 in the last 25 years.permabull said:

Cool if we can make wild ass claims with out supporting our case I say buy Bernie babies. Beats the s&p, gold and real estate over the last 25 years. Prove me wrong.

Calculator work is on the right.

The Gold Chart shows that it was at $290.38 in December of 1998. Divide the current market price of $1,960.47 by this number and you can see that we've had a 6.75X increase in the price of Gold in the last 25 years.

how about government debt from other countries?$30,000 Millionaire said:

Safest? Treasuries.

I would think Canadian government debt would be amazingly safe.

is there such a thing?

and I would argue that past performance does not equal future performancestrbrst777 said:

U. S. debt obligations are safest...also a good way to get behind. Not for me in a retirement account.

with a 32 trillion dollar debt and debt limit hostage taking sessions every year- I would think it's inevitable at some time in the future the USA misses a payment.

Again, this doesn't take into account reinvesting dividends which most people would do in a retirement account. However I'll concede that likely wouldn't make up the difference. Gold wins I guess.

LMCane said:and I would argue that past performance does not equal future performancestrbrst777 said:

U. S. debt obligations are safest...also a good way to get behind. Not for me in a retirement account.

with a 32 trillion dollar debt and debt limit hostage taking sessions every year- I would think it's inevitable at some time in the future the USA misses a payment.

The USA misses part of the payments every time they have to pay due to the devaluing of the dollar.

You need to give your definition of safe. Capital Preservation? Growth of principal over inflation? A 5% Treasury? What some folks consider safe other folks won't touch. But if I had a sum to invest in a Roth for 25 years, self directed, I'd buy an S&P Index fund.

I had a friend with a $1mm account consisting of only Apple stock. It started going down in the 2008-09 debacle and he sold, later after the markets had fully recovered he bought an index fund. He's done OK but nowhere near Apple OK.

To each their own.

I had a friend with a $1mm account consisting of only Apple stock. It started going down in the 2008-09 debacle and he sold, later after the markets had fully recovered he bought an index fund. He's done OK but nowhere near Apple OK.

To each their own.

permabull said:jagvocate said:

Gold has kept up with the S&P 500 for the last 25 years and is no one else's liability, a very important aspect in the silly world ahead.

Source? I don't care to look it up and do a research project just to prove you wrong. But since you made the claim I would like to see the work done. And don't just take s&p value from 25 years ago and what it is today, please factor in reinvesting the dividends.

I don't think it has. I just did a quick price check, and gold is up 400% over 30 years while SP is up about 1000%.

Cash under your mattress

jagvocate said:

Gold has kept up with the S&P 500 for the last 25 years and is no one else's liability, a very important aspect in the silly world ahead.

This is false.

https://www.longtermtrends.net/stocks-vs-gold-comparison/

25Azeew said:jagvocate said:

Gold has kept up with the S&P 500 for the last 25 years and is no one else's liability, a very important aspect in the silly world ahead.

This is false.

https://www.longtermtrends.net/stocks-vs-gold-comparison/

Anyone can look at a historical chart, pick the dates that work for that investment, and show that.....jagvocate said:25Azeew said:jagvocate said:

Gold has kept up with the S&P 500 for the last 25 years and is no one else's liability, a very important aspect in the silly world ahead.

This is false.

https://www.longtermtrends.net/stocks-vs-gold-comparison/

So, yes, Gold may be better looking at 25 years specifically....

But the S&P 500 is better looking at 5 years, 10 years, 30 years, 50 years. Pretty comparable at 20 years...

So S&P 500 has been a better investment overtime, per that chart. Only thing the 20 and 25 year comparisons show is that the S&P 500 went up and was roughly level for 8ish years while gold was level then went up after roughly 8 years...

If you can predict that's what's happening now, then sure.

It's not chart picking for me, it's when I got out of A&M and started buying gold. First folks didn't want to believe my proposition, and now you nitpick it with allegations of cherry picking, and I'll still be buying gold. Good luck with your S&P 500

S&P benefits from market manipulation as well. Gold? Not so much.

it's literally cherry picking.jagvocate said:

It's not chart picking for me, it's when I got out of A&M and started buying gold. First folks didn't want to believe my proposition, and now you nitpick it with allegations of cherry picking, and I'll still be buying gold. Good luck with your S&P 500

that's about the only time in the history of the S&P where you can say that gold outperformed.

glad you did well on the timing, but that doesn't make it a good investment.

I disagree with this.Andrew Dufresne said:

S&P benefits from market manipulation as well. Gold? Not so much.

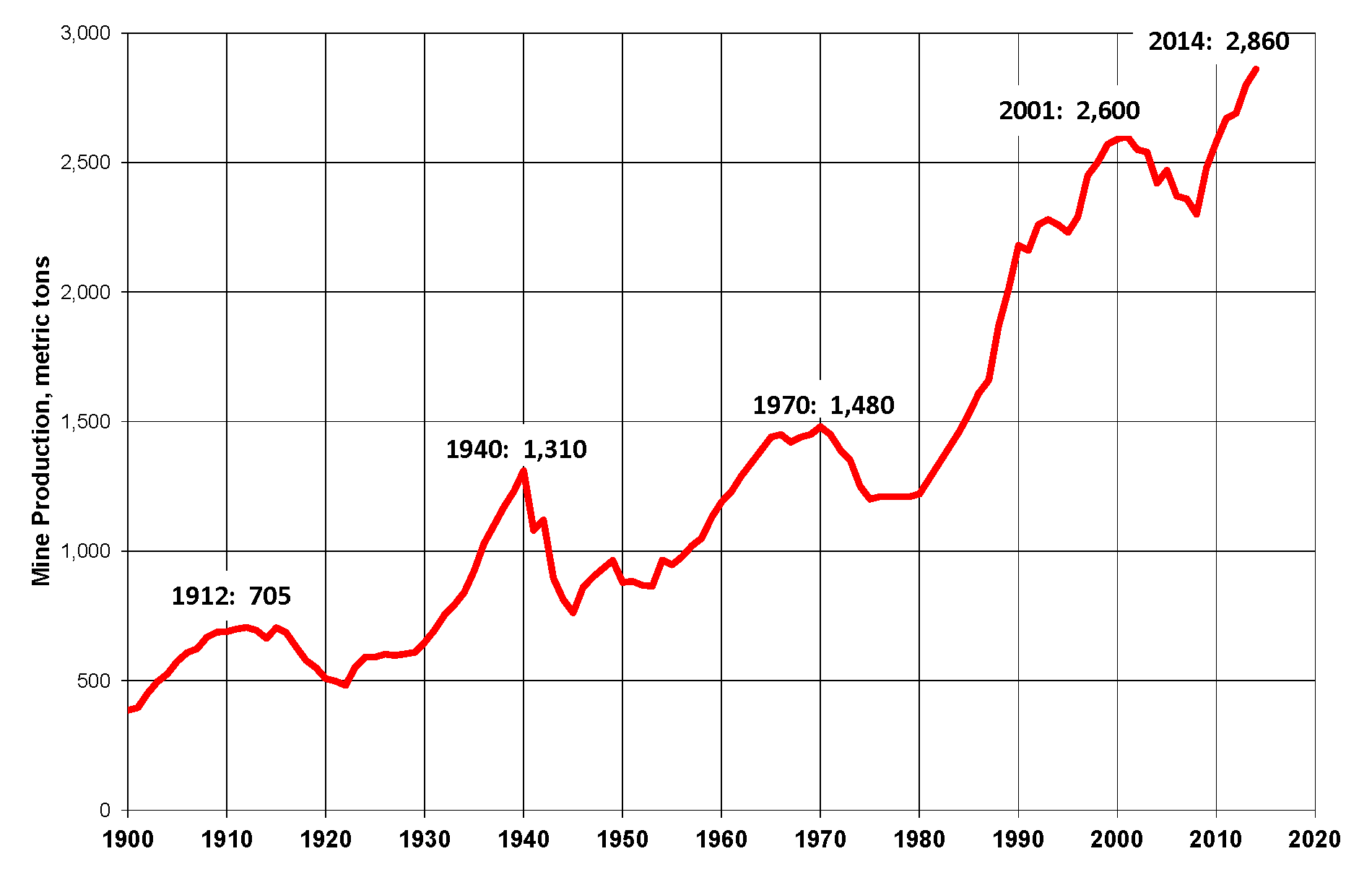

We have never mined more gold than we currently are right now. Gold's price increase is a direct result of market manipulation of currency devaluing the dollar to keep the economy going (there are other large factors, ie demand for gold in electronics). The market manipulation is so strong that even with more and more supply being mined than ever historically, it is still skyrocketing in value compared to the dollar.

That being said, gold is definitely a safe investment. Whether it provides better returns than the S&P is another story that is definitely debatable depending on your time horizon.

25 years ago was July 1998, so lets start there.jagvocate said:

It's not chart picking for me, it's when I got out of A&M and started buying gold. First folks didn't want to believe my proposition, and now you nitpick it with allegations of cherry picking, and I'll still be buying gold. Good luck with your S&P 500

As of 6/30/2023, the S&P has outperformed Gold (not even accounting for Gold's typically higher trading costs) 7.68% vs 7.42%

See:

Portfolio Visualizer <----

There are only FOUR years in the history of the S&P where a lump sum in those years has continued to outperform the S&P500. 1999, 2000, 2001, and 2002.

Gold is a fine for diversification, but don't fool yourself that its going to outperform business ownership.

I don't frequent this board and I don't have a problem with investing in gold, per se, but your statement is very misleading for a number of reasons.jagvocate said:

Gold has kept up with the S&P 500 for the last 25 years and is no one else's liability, a very important aspect in the silly world ahead.

I assume you are comparing the Gold spot price to the S&P 500 Price Index, both of which are hypothetical indices that don't likely show what a typical investor's performance would be. For gold, retail investors pay a premium to spot plus have to account for storage, transportation, and possibly insurance costs to be a real apple to apple. For stocks, someone already mentioned that dividends aren't included in the Price Index, but to be fair, neither are management fees (which probably take an avg of .1 - .2% from a total). If we just look a total return index such as the Wilshire Large Cap as the stock comparison, the returns have been slightly in stocks favor since July 18, 1998.

If you take a broader assortment of time frames, stocks have beat gold by 200% over the past 10 years, 1300% over the past 30, and about 13,000% over the past 50.

Gold has no expected return, no earnings, and no potential to grow. It has been a reasonable inflation hedge over time but it has only "kept up" with stocks in very particular cherry picked periods of time.

You can see all of these numbers and verify them yourself HERE.

Data Sources

- Online Data Robert Shiller: long term stock, bond, interest rate and consumption data

- Excel Calculation for the S&P 500 Total Return since 1871

- Federal Reserve Bank of St. Louis: Wilshire US Large-Cap Total Market Index

So gold being illiqiid is a big selling point for you?

Stock options, RSUs, or simply starting your own business.FAT SEX said:

I'd like to see you try to buy stocks below market price. I can and have purchased precious metals below market price several times.

That's just simply tax evasion.Quote:

Can you sell stocks without paying capital gains tax? I can do that with my metal when I sell privately.

This thread started with the keyword "safe."

If the S&P500 were safer than gold, the Central Bankers of the world, the insiders of the insiders, would find a way to financialize that safety.

Instead, what have they been doing?

https://www.reuters.com/markets/commodities/central-banks-bought-most-gold-since-1967-last-year-wgc-says-2023-01-31/

If the S&P500 were safer than gold, the Central Bankers of the world, the insiders of the insiders, would find a way to financialize that safety.

Instead, what have they been doing?

https://www.reuters.com/markets/commodities/central-banks-bought-most-gold-since-1967-last-year-wgc-says-2023-01-31/

RockOn said:25 years ago was July 1998, so lets start there.jagvocate said:

It's not chart picking for me, it's when I got out of A&M and started buying gold. First folks didn't want to believe my proposition, and now you nitpick it with allegations of cherry picking, and I'll still be buying gold. Good luck with your S&P 500

As of 6/30/2023, the S&P has outperformed Gold (not even accounting for Gold's typically higher trading costs) 7.68% vs 7.42%

See:

Portfolio Visualizer <----

There are only FOUR years in the history of the S&P where a lump sum in those years has continued to outperform the S&P500. 1999, 2000, 2001, and 2002.

Gold is a fine for diversification, but don't fool yourself that its going to outperform business ownership.

25 years - Sub 8% return average, for both investment vehicles. Oof.

$30,000 Millionaire said:

Safest? Treasuries.

Too much counterparty risk

Really interesting how people view clown world debt obligations as safe.

Bitcoin is a bearer instrument with no counterpart risk that can never be debased.

Bitcoin is a bearer instrument with no counterpart risk that can never be debased.

Featured Stories

See All

3:03

17h ago

9.4k

Win streak reaches four as A&M never trails at Georgia, 92-77

by Olin Buchanan

35:23

1d ago

5.2k

15:01

1d ago

4.1k

56:56

1d ago

3.0k

Reed Report: Southeastern 16's Max Barr dives into A&M's SEC surge

by Luke Evangelist

Three Things: Where Texas A&M's 2026 class ranks nationally

by Jason Howell

Infection_Ag11

Props to Trev for being bold enough to make this hire

in Billy Liucci's TexAgs Premium

20