Historically the markets always rebound, whether it be months or longer, so why would any person or institution sell if it'll be at a loss? Is it people who are overleveraged and don't have any liquid funds and rely solely on the markets?

Who is selling during a "sell off"?

4,868 Views |

41 Replies |

Last: 10 mo ago by harge57

Concern is primarily whether the recovery is fast aka 2020 or if it's a decade aka 2008

I'm concerned it's more 2008ish

I'm concerned it's more 2008ish

Better questions.

Where does the money from selling go?

We like to say that $X was wiped out from the market.... but where did it go?

The volume alone means money is changing hands, as that is the whole thing in bid/ask.

Where does the money from selling go?

We like to say that $X was wiped out from the market.... but where did it go?

The volume alone means money is changing hands, as that is the whole thing in bid/ask.

Those that are over leveraged and getting margin calls.

I have sold some stocks, but for strategic purposes.

- moving $ from an underperforming company to a better one

- taking some losses (primarily in names that I think will be slower to recover) to offset earlier gains

- moving $ from an underperforming company to a better one

- taking some losses (primarily in names that I think will be slower to recover) to offset earlier gains

2girlsdad said:

Historically the markets always rebound, whether it be months or longer, so why would any person or institution sell if it'll be at a loss? Is it people who are overleveraged and don't have any liquid funds and rely solely on the markets?

statistics I have seen show the retail investors are BUYING

it's the institutional investors who are selling.

but if you were buying in 2009 you just made a FORTUNEag94whoop said:

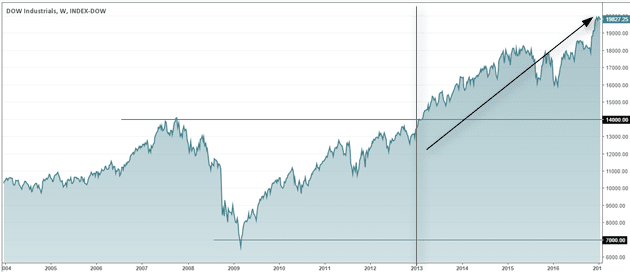

Concern is primarily whether the recovery is fast aka 2020 or if it's a decade aka 2008

I'm concerned it's more 2008ish

But if you hadn't liquidated in 2008, you weren't even at breakeven with inflation until 2013-2014 at best.

My problem is I have been focused on so many other things and fiddling with learning some option trading I hadn't really built in hedges and safeguards for this fall so I've eaten all of it and I'm honestly not sure whether it's better to just get out with a fixed loss or ride it out at this point.

My problem is I have been focused on so many other things and fiddling with learning some option trading I hadn't really built in hedges and safeguards for this fall so I've eaten all of it and I'm honestly not sure whether it's better to just get out with a fixed loss or ride it out at this point.

cgh1999 said:

I have sold some stocks, but for strategic purposes.

- moving $ from an underperforming company to a better one

- taking some losses (primarily in names that I think will be slower to recover) to offset earlier gains

Same here. Not backing out, but opportunities to rebalance.

I have yet to back up the truck though. We may be getting closer to that point. I'm just trying to not watch so closely.

Will be talking to my advisor this week about when to begin increasing my equity mix. It's all a matter of when it goes back up and how quickly rather than "if".

I inherited an IRA from my dad via Chase when he passed last year. It has someone responsible for the portfolio and passed on to me. Those idiots sold about $20k worth of stock (NVIDIA and APPLE primarily) this morning...

I will be taking control of this once I have time to peel myself off the ceiling.

I will be taking control of this once I have time to peel myself off the ceiling.

Should I be buying the dip right now?

And what stocks particularly ?

And what stocks particularly ?

Thats nuts, dont they have to get approval from the owner of the account before selling??PDEMDHC said:

I inherited an IRA from my dad via Chase when he passed last year. It has someone responsible for the portfolio and passed on to me. Those idiots sold about $20k worth of stock (NVIDIA and APPLE primarily) this morning...

I will be taking control of this once I have time to peel myself off the ceiling.

I am not an expert, so would love to be corrected on the below:SF2004 said:

Better questions.

Where does the money from selling go?

We like to say that $X was wiped out from the market.... but where did it go?

The volume alone means money is changing hands, as that is the whole thing in bid/ask.

My current assumption is that over the last week, money just was being rotated from Stocks to more defensive assets like Cash/Bonds. This means all the money was still "sitting there" as dry powder, which is why there was able to be such big swings this morning. Basically, just a re-shuffling of allocation

I think the "real" issues won't start if/until debt starts being defaulted on. Maybe in a small scale, some people getting margin called can't cover in these big market swings, but I don't think thats big enough scale to move the needle long term. But if these tariffs actually increase costs for consumers, eventually they may default on consumer debt, and a reduction in spending may cause corporations to default on their debt - there was already a lot of debt out there before the tariffs

Say stock XYZ is at $100 on Friday.SF2004 said:

Better questions.

Where does the money from selling go?

We like to say that $X was wiped out from the market.... but where did it go?

The volume alone means money is changing hands, as that is the whole thing in bid/ask.

That doesn't mean it's worth $100 per share. It means that's the last traded price. There's a bid (what someone is willing to pay) and an ask (what someone is willing to sell at).

If the bid drops to $80, and nobody is willing to pay higher, and someone decides they are willing to sell down there, then the new price is $80.

Money changed hands. Someone just spent $80 for a share. The person who sold might have bought lower, or maybe they got stopped out and lost money.

But everyone holding it gets revalued on their position at $80, a 20% loss in perceived value.

In a market crash, there is no bid. So those trying to sell end up selling at far far lower prices. They lose. Everyone holding loses their unrealized gain.

You don't get drops like thursday through today without massive margin calls.2girlsdad said:

Historically the markets always rebound, whether it be months or longer, so why would any person or institution sell if it'll be at a loss? Is it people who are overleveraged and don't have any liquid funds and rely solely on the markets?

The market is massively leveraged. Institutions and hedge fund have to have cash as collateral to hold levered positions. When the market turns against those positions, the counterparty forces them to either sell the position at a loss, or post more collateral to make up for the drop in value.

What you saw over the last week was a mass blow up of highly leverage trades. Margin calls galore. And it might not be done.

Global leveraged trades like the JPY carry trade RAISE money that has been dumped in US risk assets like NVDA. When JPY reverses, what do you think everyone associated with the now underwater short trade are going to sell to raise cash to service their underwater position? That's right. NVDA.

The real question I wonder is how far are we from bottom and then how long and how fast is recovery? Or do we sit on the floor for a while until everyone figures out the new economic reality?

I sold a bunch of company stock last week. It has been on massive run. It had dropped about 5% from the top. Now down 30% so I timed that nicely. But need to figure out where to put the cash now.

ag94whoop said:

The real question I wonder is how far are we from bottom and then how long and how fast is recovery? Or do we sit on the floor for a while until everyone figures out the new economic reality?

If I knew I would be filthy rich. Best we can do is outline he possibilities and use strategic setups to try and profit, knowing where our pivot point is and being willing to change direction when that point comes.

Petrino1 said:Thats nuts, dont they have to get approval from the owner of the account before selling??PDEMDHC said:

I inherited an IRA from my dad via Chase when he passed last year. It has someone responsible for the portfolio and passed on to me. Those idiots sold about $20k worth of stock (NVIDIA and APPLE primarily) this morning...

I will be taking control of this once I have time to peel myself off the ceiling.

He had dementia so full control was given to the manager. That was passed on to me without much thought as they were killing it…. Except for today.

My fault for not paying attention but something that can easily slip.

I'm thinking about my own situation

Outside of a few small holdings in google, RBLX, TTD, and a $170put for COIN that's a month out, most of my money is in SCHD which is actually at a small loss overall right now, and in SVOL which is at a major loss. I hadn't worried too much about SVOL despite trading against the VIX and the inherent volatility of that, it had been back by t-bills and bonds originally. But some point the last 6 months they reconstituted into SPY and other stocks as primary holdings they use as backing for their VIX trades and I hadn't caught that reconstitution until this week. My bad. So now I'm upside down net about 25% in that holding and I'm trying to decide if I should ride it out and wait for an upswing to get out or get out now and take the loss.

Outside of a few small holdings in google, RBLX, TTD, and a $170put for COIN that's a month out, most of my money is in SCHD which is actually at a small loss overall right now, and in SVOL which is at a major loss. I hadn't worried too much about SVOL despite trading against the VIX and the inherent volatility of that, it had been back by t-bills and bonds originally. But some point the last 6 months they reconstituted into SPY and other stocks as primary holdings they use as backing for their VIX trades and I hadn't caught that reconstitution until this week. My bad. So now I'm upside down net about 25% in that holding and I'm trying to decide if I should ride it out and wait for an upswing to get out or get out now and take the loss.

EastTX_Aggie said:

Should I be buying the dip right now?

And what stocks particularly ?

This. I'm just a caveman. I'm waiting for someone to tell me to buy. Didn't have the cash in 09. Now I do.

lol same in a sense. I'm just now 4 years out of college and have a little money to invest.

I'm a casual to this stuff but trying to learn more.

But I'm just trying to time it right, because the market will eventually come back up to normal.

I'm thinking Amazon would be a solid buy during the dip

I'm a casual to this stuff but trying to learn more.

But I'm just trying to time it right, because the market will eventually come back up to normal.

I'm thinking Amazon would be a solid buy during the dip

Listen to others smarter than me but don't try to time it. Mid 20s? I say buy, buy, buy. In the long run you'll come out way ahead. Had I pumped all I could in in 2007 I'd still be much better off now.

Just buy the S&P 500 and QQQ, literally thats all you need. If you want to risk more in an individual stock, look at any of the Magnificent 7 stocks and pick one or two thats been hit the hardest in the past few weeks.NoahAg said:EastTX_Aggie said:

Should I be buying the dip right now?

And what stocks particularly ?

This. I'm just a caveman. I'm waiting for someone to tell me to buy. Didn't have the cash in 09. Now I do.

Just keep buying. You're so far out from retiring it doesn't even matter. Time in the market is the key for you.EastTX_Aggie said:

lol same in a sense. I'm just now 4 years out of college and have a little money to invest.

I'm a casual to this stuff but trying to learn more.

But I'm just trying to time it right, because the market will eventually come back up to normal.

I'm thinking Amazon would be a solid buy during the dip

I reallocated in December from somewhere around 85/15 equities to fixed income to 75/25 because I knew there would be volatility and I wanted to protect more of our nest egg.

Still took a big hit since last week but I at least mitigated it somewhat. I half jokingly posted this elsewhere but I'm looking at it like this: using the Dow as your barometer, we are back to numbers from a year ago.

So this isn't catastrophic....yet.

The one thing I did sell was the last of our LUV near the 52 week high so that was great timing.

Still took a big hit since last week but I at least mitigated it somewhat. I half jokingly posted this elsewhere but I'm looking at it like this: using the Dow as your barometer, we are back to numbers from a year ago.

So this isn't catastrophic....yet.

The one thing I did sell was the last of our LUV near the 52 week high so that was great timing.

Got it!txaggie_08 said:Just keep buying. You're so far out from retiring it doesn't even matter. Time in the market is the key for you.EastTX_Aggie said:

lol same in a sense. I'm just now 4 years out of college and have a little money to invest.

I'm a casual to this stuff but trying to learn more.

But I'm just trying to time it right, because the market will eventually come back up to normal.

I'm thinking Amazon would be a solid buy during the dip

What exactly do you mean by "time in the market". Like the best time to buy the stock when it's at a low I assume?

Meaning length of time not timing your entry or exit. At your age, don't worry about trying to time a low right now. You have the benefit of years of letting that money grow and compound. Just set it an forget it, invest routinely over the next 10-15 years and watch it grow.EastTX_Aggie said:Got it!txaggie_08 said:Just keep buying. You're so far out from retiring it doesn't even matter. Time in the market is the key for you.EastTX_Aggie said:

lol same in a sense. I'm just now 4 years out of college and have a little money to invest.

I'm a casual to this stuff but trying to learn more.

But I'm just trying to time it right, because the market will eventually come back up to normal.

I'm thinking Amazon would be a solid buy during the dip

What exactly do you mean by "time in the market". Like the best time to buy the stock when it's at a low I assume?

Then when you are older, pass along the advice to someone in your shoes. The one thing you can not get back is time. It's your best friend at this stage of investing.

Aglaw97 said:Meaning length of time not timing your entry or exit. At your age, don't worry about trying to time a low right now. You have the benefit of years of letting that money grow and compound. Just set it an forget it, invest routinely over the next 10-15 years and watch it grow.EastTX_Aggie said:Got it!txaggie_08 said:Just keep buying. You're so far out from retiring it doesn't even matter. Time in the market is the key for you.EastTX_Aggie said:

lol same in a sense. I'm just now 4 years out of college and have a little money to invest.

I'm a casual to this stuff but trying to learn more.

But I'm just trying to time it right, because the market will eventually come back up to normal.

I'm thinking Amazon would be a solid buy during the dip

What exactly do you mean by "time in the market". Like the best time to buy the stock when it's at a low I assume?

Then when you are older, pass along the advice to someone in your shoes. The one thing you can not get back is time. It's your best friend at this stage of investing.

^Getting very good advice, all of the above. Only other thing I'd suggest is dollar cost average over a certain time period and not necessarily feel like you need to dump it all in at once. Just be disciplined about it. Drop a set % of what you have saved every few weeks into VTI or VOO and do that over the next several months. And then keep doing that the rest of your career.

I operate with a 5 year horizon. Whatever I need in that time should be more conservative. Everything else i'm staying 100% in equities and keep buying more

EastTX_Aggie said:

lol same in a sense. I'm just now 4 years out of college and have a little money to invest.

I'm a casual to this stuff but trying to learn more.

But I'm just trying to time it right, because the market will eventually come back up to normal.

I'm thinking Amazon would be a solid buy during the dip

Early 30s here and my plan has been as follows:

1. Dollar cost average in my 401k and Roth IRA investments and let time in the market do its thing. I max out to the contribution limit.

2. Any money that I am investing that is not tax advantaged, I will be much more picky. I have a list of stocks and ETFs that I will track with respect to what I believe is fair value, and will only buy with an additional 10% margin of safety with respect to that value.

Best of wishes to you on your early journey. No path is the same.

I'd really love to hear their logic on selling a leading tech company that pays a dividend.PDEMDHC said:

I inherited an IRA from my dad via Chase when he passed last year. It has someone responsible for the portfolio and passed on to me. Those idiots sold about $20k worth of stock (NVIDIA and APPLE primarily) this morning...

I will be taking control of this once I have time to peel myself off the ceiling.

Which brokerage did this? Did you sign new papers? You should have, once an account owner dies trading stops until the control person is in place. If your dad is still on the papers as the owner you can absolutely get those trades reversed.PDEMDHC said:Petrino1 said:Thats nuts, dont they have to get approval from the owner of the account before selling??PDEMDHC said:

I inherited an IRA from my dad via Chase when he passed last year. It has someone responsible for the portfolio and passed on to me. Those idiots sold about $20k worth of stock (NVIDIA and APPLE primarily) this morning...

I will be taking control of this once I have time to peel myself off the ceiling.

He had dementia so full control was given to the manager. That was passed on to me without much thought as they were killing it…. Except for today.

My fault for not paying attention but something that can easily slip.

Backyard Gator said:I'd really love to hear their logic on selling a leading tech company that pays a dividend.PDEMDHC said:

I inherited an IRA from my dad via Chase when he passed last year. It has someone responsible for the portfolio and passed on to me. Those idiots sold about $20k worth of stock (NVIDIA and APPLE primarily) this morning...

I will be taking control of this once I have time to peel myself off the ceiling.

A number of fiduciaries will go to cash in that situation because they have a new client and they don't know their risk tolerance/potential need for the cash. Since there was no tax consequences from the sale, they will say we went to cash and it is easy to redeploy it after meeting with the new client.

Featured Stories

See All

16:13

59m ago

765

11:13

18h ago

2.0k

6:46

13h ago

3.8k

Janneh's injury pops A&M's bubble hopes at SEC Tournament

by Kay Naegeli

9:46

12h ago

1.5k

Lessentine tosses complete game in run-rule of Louisiana Tech

by Kayla Gaither

14:04

1h ago

534

@coopercuffe

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

78

BetterNotBeChipKelly

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

75

@coopercuffe

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

47

PatriotAg02

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

44

RAM700BA

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

33

Stupe

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

31

OKCAG02

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

29

Wynn.derong

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

21

MattAg84

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

19

fdt67ag

Maryland scored 45 points in a whole basketball game tonight

in Billy Liucci's TexAgs Premium

17