[Do not bypass obscenity filters -- Staff]

Trump to Cap Credit Card Interest at 10%

14,495 Views |

243 Replies |

Last: 22 days ago by Correction

He did make campaign promises on this iirc

How about we set the maximum income tax rate at 10% and worry about credit cards later.

Everything the Trump admin is doing is working. Keep trying to find a problem

All this will result in if it ever passed is credit becoming unavailable to many people.

That would be a nice lifeline for all the folks that are getting clobbered by student loan repayment right now.

If this happens, the next Dem potus will definitely be doing the same.

If this happens, the next Dem potus will definitely be doing the same.

Looks to be the first amendment.AtticusMatlock said:

Under what legal authority is he doing this?

Get Off My Lawn said:Looks to be the first amendment.AtticusMatlock said:

Under what legal authority is he doing this?

Ha! Well played!

I'm Gipper

Pretty dumb but I wonder how many are even aware of what their interest rates are. Our credit score is perfect yet all of my CC interest rates are within 1-2 pts of 20% which seems high to me. Irrelevant to me because I pay it off every month but I remember the days when my primary card was 9%.

Quote:

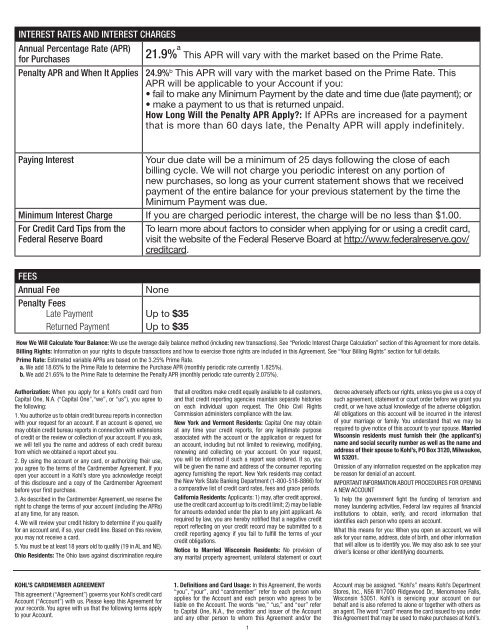

An executive order could tell agencies like the CFPB, OCC, FDIC, and even the Federal Reserve to study the issue, tighten supervision, or lean on banks through enforcement and exams. But without Congress changing the law, usually by amending the Truth in Lending Act or the National Bank Act itself.a hard 10% cap wouldn't legally stick and would almost certainly get challenged in court.

That said, pressure still matters. Banks care deeply about regulatory heat and public optics. When a president is openly calling 2030% APRs a rip off, regulators start asking questions, headlines turn ugly, and banks start managing risk. You probably don't get a clean 10% cap, but you can see behavior shift at the margins with more promo rates, lower APRs for prime customers, expanded hardship programs, fee tweaks, or quieter changes meant to avoid looking predatory.

So he's basically setting an anchor. A simple number people instantly understand. It reframes the issue from abstract rates or monetary policy to "banks are gouging consumers," which plays well when households are under pressure. More importantly, it signals to banks that this could become real legislation if the economy weakens and Congress feels forced to act.

So i believe this is less about the mechanics of law and more about leverage and timing. Credit cards are the most visible consumer pain point. He's planting a flag there early. If Congress moves, he claims the win. If banks preemptively adjust, he still claims success. And if nothing changes, he still owns the narrative. That's the real play.

Credit card rates are governed by the National Bank Act, which lets nationally chartered banks charge interest based on the rules of their home state. That’s why so much credit card lending runs through places like Delaware and South Dakota. That setup was locked in by the 1978… https://t.co/utH3KMa2wN

— EndGame Macro (@onechancefreedm) January 10, 2026

I'm Gipper

AtticusMatlock said:

Consumer spending among middle and lower classes is already in the toilet. Almost all the consumer spending growth we've seen in the last two years has been from high income earners and people heavily invested in the stock market. We are in a K-shaped economy.

I don't buy that. Total credit card debt was at $1.2 trillion at end of Q3 which is a record high. That's not just high income earners. In fact, I'd bet the vast majority is middle class.

I'm getting really tired of Trumps ***** More regulations and more government control. Let the markets dictate what rates should be.

Logos Stick said:AtticusMatlock said:

Consumer spending among middle and lower classes is already in the toilet. Almost all the consumer spending growth we've seen in the last two years has been from high income earners and people heavily invested in the stock market. We are in a K-shaped economy.

I don't buy that. Total credit card debt was at $1.2 trillion at end of Q3 which is a record high. That's not just high income earners. In fact, I'd bet the vast majority is middle class.

I think it's murky. The WSJ did an article on this a year or so ago and found that within the high end luxury goods sectors most of the spending was actually being done by the younger middle class. Specifically, they highlighted all of these 20 something's who were living at home who had no housing costs to speak of which freed up their income to go spend on luxury goods.

Legal authority aside: for those who oppose this - what's your reasoning? Capping allowable interest rates would effectively push these companies to deny high risk applicants who are most likely to fall into an unrecoverable debt spiral. How is it an inherent good for our country to allow bankers to create financial traps?

There are already laws to protect young servicemen from predatory lending / rates as well as layers of individual oversight. The effect is PVTs with a Civics instead of Chargers and a mitigation of external extortionary opportunity.

Please enlighten me if I'm missing something. Who does a 30% rate benefit?

There are already laws to protect young servicemen from predatory lending / rates as well as layers of individual oversight. The effect is PVTs with a Civics instead of Chargers and a mitigation of external extortionary opportunity.

Please enlighten me if I'm missing something. Who does a 30% rate benefit?

Get Off My Lawn said:

Legal authority aside: for those who oppose this - what's your reasoning? Capping allowable interest rates would effectively push these companies to deny high risk applicants who are most likely to fall into an unrecoverable debt spiral. How is it an inherent good for our country to allow bankers to create financial traps?

There are already laws to protect young servicemen from predatory lending / rates as well as layers of individual oversight. The effect is PVTs with a Civics instead of Chargers and a mitigation of external extortionary opportunity.

Please enlighten me if I'm missing something. Who does a 30% rate benefit?

I'm not taking a hard stance on it either way, but I generally do not support price controls which is basically a version of it. I would posit that capping rates at 10% could/would actually lead to even more spending by many because you've just lessened some of the pain from doing it. Most people are financially tards so many will look at it this way.

You will also see many of the best rewards programs go away if a 10% cap is put in place (which I don't think happens)

I'm Gipper

I'm Gipper

Keep in mind that he might not actually want that to happen. He might be applying pressure to achieve some other change or effect as a response. It is one of his commonly used tactics

Get Off My Lawn said:

Legal authority aside: for those who oppose this - what's your reasoning? Capping allowable interest rates would effectively push these companies to deny high risk applicants who are most likely to fall into an unrecoverable debt spiral. How is it an inherent good for our country to allow bankers to create financial traps?

There are already laws to protect young servicemen from predatory lending / rates as well as layers of individual oversight. The effect is PVTs with a Civics instead of Chargers and a mitigation of external extortionary opportunity.

Please enlighten me if I'm missing something. Who does a 30% rate benefit?

It's called freedom. The government needs to stay out of the business of setting prices and interest rate caps/floors in private contracts. The Fed is challenged enough to try and set the open market lending rate from the government to banks.

There was a time in life when I was young and poor, and we had to use cc's as a last resort to put food on the table and take kids to the doctor. I didn't like the interest that I paid for years, but it was an absolute lifeline to get through that stage of life.

I didn't need daddy government telling me what I could and couldn't do.

Freedom is a beautiful thing but it comes with owning the consequences of our decisions. Too many people -- including Trump in this case -- want to individualize choices but socialize the consequences.

To hell with that!

Individuals that have high interest rates on credit cards generally have low credit scores due to not historically paying their unsecured debts. The result of any regulation will be that these folks cards will be cancelled. They're too risky and credit card issuers won't lose money on the product. High risk consumers will be left with the option of a debit card with no overdraft loan option.

3rd Coast said:

I'm getting really tired of Trumps ***** More regulations and more government control. Let the markets dictate what rates should be.

Then vote for a Dem next time.

The ripping off of America by corporations is finally ending.

Im Gipper said:

You will also see many of the best rewards programs go away if a 10% cap is put in place (which I don't think happens)

In parallel, it remains to be seen what the recent changes to merchant fees portend for these cards. Likely not a factor in large markets, but I could see it potentially impacting me in the small town I live in. I'm going to guess the mix of people in my town does not have a large number of locals paying the ~$1k annual fees to Chase Sapphire and AMEX Platinum premium cards. Merchant fees will be higher for using those cards so merchants can just refuse to take them now.

Won't make any sense for me to carry that card when my costs are going up and access goes down. I'm already going to downgrade anyway but both these policies will put downward pressure on rewards programs.

Bernie bros

I'm Gipper

Since Trump took office, life has only gotten more expensive for working class people.

— Bernie Sanders (@BernieSanders) February 13, 2025

Here’s an idea: How about Trump fulfills his campaign promise and caps credit card interest rates at 10% for every American.

I have the legislation to do just that. pic.twitter.com/JqOECnvmrm

I'm Gipper

Teslag said:infinity ag said:TexasAggie73 said:

Wouldn't that be lowering the profit levels for banks and their stockholders?

Yeah and no one cares

You will when you see what it does to consumer spending

Yes, this will indirectly hurt me because I am a disciplined spender and good investor. I don't need to be making money off the misery of others who in many cases don't have an option.

It will protect those who are not as disciplined as I from getting their lives ruined because they could not do math. We will see fewer bankruptcies and fewer people rendered homeless. I will make a few dollars less, and I am okay with it. God has given be enough, I am not a CEO to lust for more than I can spend.

javajaws said:infinity ag said:

Good Trump!

Every time Trump sticks it to scummy CEOs, I celebrate!

So what other products and services do you support price caps for?

If you give me a list, I can tell you.

infinity ag said:3rd Coast said:

I'm getting really tired of Trumps ***** More regulations and more government control. Let the markets dictate what rates should be.

Then vote for a Dem next time.

The ripping off of America by corporations is finally ending.

No one is forced to obtain and use a credit card. Nobody is being ripped off by the banks.

If you were to do something stupid like this, non collateralized credit would completely dry up for a huge number of Americans.

I hate the interest rate CC's charge but gov shouldn't be stepping in here. Let morons be morons and fail.

Quote:

Legal authority aside: for those who oppose this - what's your reasoning?

"Aside". Huh? I don't want the government to be able to do whatever it wants, regardless how "good" it is. And even more so don't want EOs doing whatever they want.

https://t.co/AcMysFdxiV pic.twitter.com/M0DzYz1YxA

— Scott Lincicome (@scottlincicome) January 10, 2026

Logos Stick said:infinity ag said:3rd Coast said:

I'm getting really tired of Trumps ***** More regulations and more government control. Let the markets dictate what rates should be.

Then vote for a Dem next time.

The ripping off of America by corporations is finally ending.

No one is forced to obtain and use a credit card. Nobody is being ripped off by the banks.

If you were to do something stupid like this, non collateralized credit would completely dry up for a huge number of Americans.

In theory, yes. But in practice? There is a lot of deception and fine-print and long long long agreements that no one can understand.

I know how to read them and I am suspicious of all corporations anyway, so I am 99% okay. You got to be really smooth and clever to gyp me.

But Uncle Jim and Aunt Martha? They will get scammed and the corporations have their CYA (the looooooong agreement).

Trump is stopping that. He is a realist, not a theorist. This is no different from having age caps to prevent underage sex and age cap for smoking.

infinity ag said:3rd Coast said:

I'm getting really tired of Trumps ***** More regulations and more government control. Let the markets dictate what rates should be.

Then vote for a Dem next time.

The ripping off of America by corporations is finally ending.

How do high credit card rates "rip off" America?

Teslag said:infinity ag said:3rd Coast said:

I'm getting really tired of Trumps ***** More regulations and more government control. Let the markets dictate what rates should be.

Then vote for a Dem next time.

The ripping off of America by corporations is finally ending.

How do high credit card rates "rip off" America?

The problem is for people who don't understand the math of it. Not you and I who have A&M degrees.

infinity ag said:Teslag said:infinity ag said:TexasAggie73 said:

Wouldn't that be lowering the profit levels for banks and their stockholders?

Yeah and no one cares

You will when you see what it does to consumer spending

Yes, this will indirectly hurt me because I am a disciplined spender and good investor. I don't need to be making money off the misery of others who in many cases don't have an option.

It will protect those who are not as disciplined as I from getting their lives ruined because they could not do math. We will see fewer bankruptcies and fewer people rendered homeless. I will make a few dollars less, and I am okay with it. God has given be enough, I am not a CEO to lust for more than I can spend.

Do you know what ripple effects are?

I just think this is overthinking it.

Bottom line: everyone knows that a CC company is going to penalize you and charge you for carrying a balance month to month. Higher the interest rate; the more they will charge you.

I've never read the fine print on my CC agreements because it's unnecessary. Common sense and logic are all that's needed here.

That's all there is to it.

Bottom line: everyone knows that a CC company is going to penalize you and charge you for carrying a balance month to month. Higher the interest rate; the more they will charge you.

I've never read the fine print on my CC agreements because it's unnecessary. Common sense and logic are all that's needed here.

That's all there is to it.

infinity ag said:Logos Stick said:infinity ag said:3rd Coast said:

I'm getting really tired of Trumps ***** More regulations and more government control. Let the markets dictate what rates should be.

Then vote for a Dem next time.

The ripping off of America by corporations is finally ending.

No one is forced to obtain and use a credit card. Nobody is being ripped off by the banks.

If you were to do something stupid like this, non collateralized credit would completely dry up for a huge number of Americans.

In theory, yes. But in practice? There is a lot of deception and fine-print and long long long agreements that no one can understand.

I know how to read them and I am suspicious of all corporations anyway, so I am 99% okay. You got to be really smooth and clever to gyp me.

But Uncle Jim and Aunt Martha? They will get scammed and the corporations have their CYA (the looooooong agreement).

Trump is stopping that. He is a realist, not a theorist. This is no different from having age caps to prevent underage sex and age cap for smoking.

The rate is literally there in bold bold numbers. Stop making excuses for idiots.

infinity ag said:Teslag said:

How do high credit card rates "rip off" America?

The problem is for people who don't understand the math of it. Not you and I who have A&M degrees.

We shouldn't use the power of government to protect stupid people at the expense of smarter people.

I've made plenty of stupid mistakes in my life and learned from them because of the pain involved.

Those who don't learn from their mistakes are doomed to repeat them. Sad, but it cleans the gene pool of idiots if allowed to run its course. We are dumbing down the gene pool by protecting people from their own idiocy.

Featured Stories

See All

21:20

8h ago

1.9k

Lack of height bites A&M in 86-85 loss to Mizzou

by Olin Buchanan

5 Thoughts: Missouri 86, Texas A&M 85

by Luke Evangelist

2 Days 'til: Powerful trio sets aside first-round aspirations

by Richard Zane

26:30

20h ago

4.3k

5:26

8h ago

482

Game Highlights: Missouri 86, Texas A&M 85

by Matthew Dawson