You should use multiple wallets

1 BTC = $0.06M today. New All Time High

14,892 Views |

111 Replies |

Last: 10 mo ago by kyledr04

You might end up dedicating your life to searching a landfill.

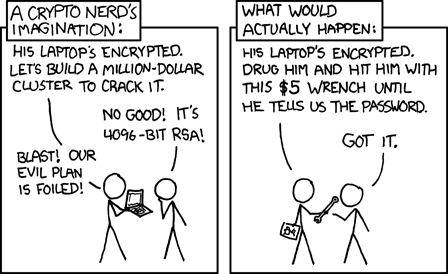

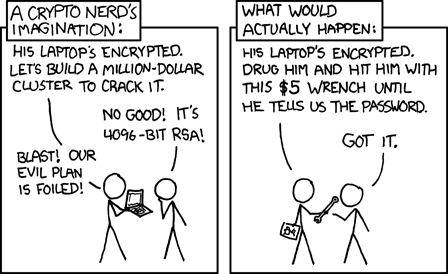

$5 Wrench attacks are real.

Don't become a target.

Don't become a target.

LMCane said:

the higher the price is going

the more stressed I am about having my BTC on a cold storage wallet and somehow screwing it up

I'd recommend multi-sig through Unchained Capital. It will save you from your self.

Reference:

LatinAggie1997 said:

Lots on this forum laughed at me when I commented that money managers, institutions, and even RIA, would get into and recommend BTC.

Many on here are skeptics and will likely fall into the laggards category. Some will shift their mindset and get exposure.

Either way, we shall see each other on the other side of the curve with the only difference being the net worth of early adopters - Red or Black.

What changed about Bitcoin for them to change their minds?

Well, fundamentally Bitcoin is the same useless asset it's always been.

Higher price, and fees for ETF AUM.

In 2010, some buddies I worked with spun up a few old work computers to mine BTC. They asked if I wanted in on the mining action - I passed. However, a couple of things I liked about BTC was the block-chain technology and the politics of a parallel fiscal/monetary system thumbing it's nose at the establishment. Unfortunately, much of the libertarian inspiration for BTC seems to have morphed into a desperate need for establishment acceptance, price speculation, moonbois, and future lambo orders. Sad to me where it all started and what it has become.bmks270 said:What changed about Bitcoin for them to change their minds?LatinAggie1997 said:

Lots on this forum laughed at me when I commented that money managers, institutions, and even RIA, would get into and recommend BTC.

Many on here are skeptics and will likely fall into the laggards category. Some will shift their mindset and get exposure.

Either way, we shall see each other on the other side of the curve with the only difference being the net worth of early adopters - Red or Black.

Well, fundamentally Bitcoin is the same useless asset it's always been.

Higher price, and fees for ETF AUM.

TTUArmy said:In 2010, some buddies I worked with spun up a few old work computers to mine BTC. They asked if I wanted in on the mining action - I passed. However, a couple of things I liked about BTC was the block-chain technology and the politics of a parallel fiscal/monetary system thumbing it's nose at the establishment. Unfortunately, much of the libertarian inspiration for BTC seems to have morphed into a desperate need for establishment acceptance, price speculation, moonbois, and future lambo orders. Sad to me where it all started and what it has become.bmks270 said:What changed about Bitcoin for them to change their minds?LatinAggie1997 said:

Lots on this forum laughed at me when I commented that money managers, institutions, and even RIA, would get into and recommend BTC.

Many on here are skeptics and will likely fall into the laggards category. Some will shift their mindset and get exposure.

Either way, we shall see each other on the other side of the curve with the only difference being the net worth of early adopters - Red or Black.

Well, fundamentally Bitcoin is the same useless asset it's always been.

Higher price, and fees for ETF AUM.

As a fellow 2010 "almost mined" individual, I have a completely opposite perspective.

When you can filter through the noise and grab the signal, you've created a new level of resilience for yourself.

Majority of bitcoiners resisted tooth and nail the COVID nonsense from the start, for instance, because we focused on where the incentives aligned and saw through the charade.

It's a truth seeking journey, not a get rich quick scheme.

that's an interesting ideaYukon Cornelius said:

You should use multiple wallets

wouldn't it just make it harder to keep track of 2 or 3 wallets? I already have one lockbox- now buy 3 lockboxes and hide them in different places?!

it seems difficult to remember and preserve two or three sets of passcodes.

Fightin2010 said:LMCane said:

the higher the price is going

the more stressed I am about having my BTC on a cold storage wallet and somehow screwing it up

I'd recommend multi-sig through Unchained Capital. It will save you from your self.

More information on this please.

you believe Unchained Capital is safer than just keeping it on Coinbase?

or a "spot ETF" for BTC on Fidelity?

what is this?Algorithmic Epiphany said:

$5 Wrench attacks are real.

Don't become a target.

what Hunter is posting below?

Yes.

Please tell me you didn't pass up the ledger Christmas deal?

Multiple wallets for various reasons. One being If you cash out one day you'll connect said wallet. If you somehow comprise the wallet in the process you could be instant drained. Was reading a story a week ago someone held in an exodus "hot" wallet on an unconnected phone. He connected to Wi-Fi to make it hot to transfer etc. update tbe exodus wallet but got tbe update from a bad source. Instant drained his entire stack of 10 btc.

How do you get a bad update these days on an app wallet? Either you're updating from the exodus website if a computer or the App Store.

Holding 10 BTC on exodus is very stupid but is a separate issue.

Holding 10 BTC on exodus is very stupid but is a separate issue.

“There is no red.

There is no blue.

There is the state.

And there is you.”

“As government expands, Liberty contracts” - R. Reagan

There is no blue.

There is the state.

And there is you.”

“As government expands, Liberty contracts” - R. Reagan

Dude didn't use the App Store. Idk what he was thinking. But he had 10 because he had them for years when they were much cheaper. Felt horrible for the guy reading about it. But that's just one example. They're a lot of people putting a lot of time and money into how to corrupt the process.

LMCane said:Fightin2010 said:LMCane said:

the higher the price is going

the more stressed I am about having my BTC on a cold storage wallet and somehow screwing it up

I'd recommend multi-sig through Unchained Capital. It will save you from your self.

More information on this please.

you believe Unchained Capital is safer than just keeping it on Coinbase?

or a "spot ETF" for BTC on Fidelity?

Unchained Capital cannot access your coins without you. They live in a wallet in which you have two keys and they have one, and two keys have to be "turned" at the same time in order to access. At all times you can access your coins without them but if something ever happened to one of your keys you can use theirs. This takes away the fear of some a-hole running off with your Trezor.

I was in a similar boat with my own wallet and I was losing sleep over sketchy dog sitters coming over to the house etc. After getting unchained I now rest easy. I recommend setting up a call with them, and it's only a $400 one time fee to get set up.

https://unchained.com/vaults

It's important to study Bitcoin.

txaggie_08 said:

But how are you buying BTC in a 401k?

BTC ETF's from major institutions, or GBTC, BITO, or similar.

Yeah, so not actually buying BTC to utilize as it's been preached for 10+ years, but instead speculating on the price of BTC and wanting to profit from it. BTC fanboys have really changed their tune from it being this debased currency that can be used transactionally if the world turns to ****, to now they just want to invest in it for the USD gains. Much less about "currency" today and more about an alternative investment that's highly speculative and, ultimately, valued against the almighty dollar.

It's a financial game of "the floor is lava".

You asked how to get exposure to BTC in a 401k; I provided several options. Me personally, the potential for BTC to both increase in value relative to the USD and general acceptance on a larger scale is worth having some in cold storage.

I can provide options for that as well.

I can provide options for that as well.

No I didn'tXpressAg09 said:

You asked how to get exposure to BTC in a 401k; I provided several options. Me personally, the potential for BTC to both increase in value relative to the USD and general acceptance on a larger scale is worth having some in cold storage.

I can provide options for that as well.

txaggie_08 said:No I didn'tXpressAg09 said:

You asked how to get exposure to BTC in a 401k; I provided several options. Me personally, the potential for BTC to both increase in value relative to the USD and general acceptance on a larger scale is worth having some in cold storage.

I can provide options for that as well.

Oh man you got him good! You're totally going to be way better off not having Bitcoin than him actually having cold storage Bitcoin and traditional market Bitcoin exposure! Man I can't wait to congratulate you in another few years when Bitcoin is in the hundreds of thousands of US dollars. The we can really make fun of him!

BLACKROCK LAUNCHING TOKENIZED ASSET FUND ON ETHEREUM, SEEDS IT WITH $100M

— The Wolf Of All Streets (@scottmelker) March 20, 2024

Blackrock, the world's largest asset manager, has taken significant steps towards integrating digital assets into its portfolio by submitting a request to the U.S. Securities and Exchange Commission (SEC)… pic.twitter.com/nRUBnK5iYJ

Surprised it took them this long.

The responses to BTC receiving mainstream support from institutions from the haters tells you everything you need to know about discussing it with them. They don't actually care. They are no different than the OP of the "why we shouldn't be concerned about inflation" thread.

Alt shopping coming

If it really hits the fan later this year and we start to see cascading failures in the banking, finance, and insurance markets we going to see a huge amount of cash dumped into these ETFs.

Even if you don't like the idea of bitcoin for whatever reason, your choice of lifeboats are limited. So it makes sense to have some percentage tied in with Bitcoin.

Why am I wrong about this?

Even if you don't like the idea of bitcoin for whatever reason, your choice of lifeboats are limited. So it makes sense to have some percentage tied in with Bitcoin.

Why am I wrong about this?

Stat Monitor Repairman said:

Why am I wrong about this?

You're not.

Stat Monitor Repairman said:

If it really hits the fan later this year and we start to see cascading failures in the banking, finance, and insurance markets we going to see a huge amount of cash dumped into these ETFs.

Even if you don't like the idea of bitcoin for whatever reason, your choice of lifeboats are limited. So it makes sense to have some percentage tied in with Bitcoin.

Why am I wrong about this?

I doubt it. If stock market were to have a big pullback so will BTC.

What kind of lifeboat is a BTC ETF? For the BTC fanboys, its not actual BTC. What would stop the BTC ETFs from not tanking just like the overall market?

txaggie_08 said:

I doubt it. If stock market were to have a big pullback so will BTC.

BTC is more tied to the lack of long term faith in the USD than the economy or market.

Consider these two-year snapshots of performance by BTC, DJIA, and FXAIX.

When looking at those charts, when I see any meaningful market pullback, I also see pull back in BTC.Quote:

BTC is more tied to the lack of long term faith in the USD than the economy or market.

See: 8/2015, 12/2105 - 1/2016, 6/2016 - 7/2016, 3/2020. Outside of that is a lot of erratic behavior by BTC.

txaggie_08 said:

. Outside of that is a lot of erratic behavior by BTC.

That's a funny way of saying "BTC goes up."

sounds like gold and BTC on Wall Street will be huge when things start to break.Stat Monitor Repairman said:

If it really hits the fan later this year and we start to see cascading failures in the banking, finance, and insurance markets we going to see a huge amount of cash dumped into these ETFs.

Even if you don't like the idea of bitcoin for whatever reason, your choice of lifeboats are limited. So it makes sense to have some percentage tied in with Bitcoin.

Why am I wrong about this?

also when there is the transfer of assets from old people dying off and leaving their estates to millenials and Gen Z who would be more likely to invest in Bitcoin than in IBM.

Featured Stories

See All

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

by Richard Zane

38:04

14h ago

2.9k

Baseball Thoughts: Analyzing A&M's 'choppy' start through six games

by Ryan Brauninger

21:49

16h ago

2.3k

NyAggie

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

in Billy Liucci's TexAgs Premium

6

AggieCrew44

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

in Billy Liucci's TexAgs Premium

5

AggieCrew44

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

in Billy Liucci's TexAgs Premium

5

tboag

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

in Billy Liucci's TexAgs Premium

3

AggieCrew44

Texas A&M third baseman Gavin Grahovac to miss remainder of 2025

in Billy Liucci's TexAgs Premium

3