Heineken-Ashi said:

AggiEE said:

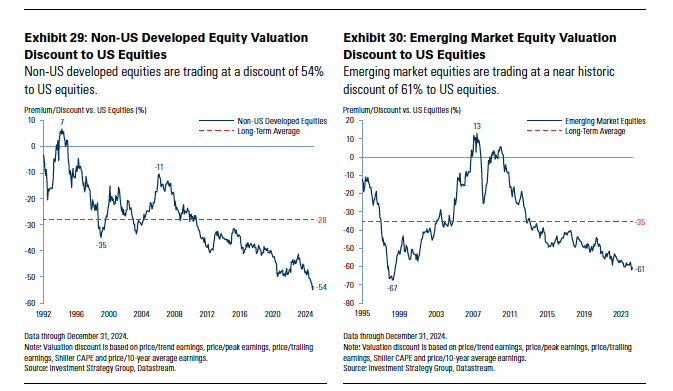

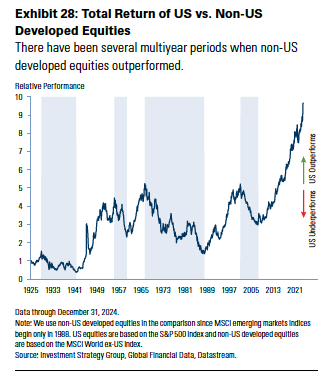

The US market is priced for perfection with a CAPE of 40. The last time valuations were roughly this high, the market had a negative real return for 13 years

All of this information is already priced in, it's not enough for the US companies to be exceptional; they must be more exceptional than the market has priced in for this to continue.

History says, don't count on it

Well said from a fundamentals viewpoint.

But to keep it simple, markets never have traded purely on fundamentals. More on mass herding and social mood patterns.

Think of it this way.. if a stock perfectly priced based on the most aggressive future growth potential hits the level it "should" be at in that scenario.. what next? Does it go flat? No. The stock will often trade up and beyond reasonable measures of objective value, and then down well below what would be considered a discounted value. That isn't an entire market efficiently pricing in the future. It's sentiment running its course. And earnings and fundamentals always always trail sentiment. If you are waiting on the fundamentals to make a decision, you will always be the last to know of the good times and last to know when good times are over.

Totally agree - there's tons of recency bias, momentum, and speculation that can drive this market very high. We saw what happened with Japan in the 80s and 90s. There were all sorts of narratives that justified their market being priced as high as it was.

It would not surprise me to see this market continue roaring upward, especially if there's any tangible surprises with AI technology that keep people drunk on the idea that price doesn't matter. This is true for any speculative bubble.

But I also know that, as a long term investor, the fundamentals always start to matter. You don't need the US valuations to contract for returns to be poor either. By simply being static and high, the earnings yield ultimately results in lesser returns. So to expect another decade like the one you've had, you really need to count on valuations to continue to rise to astronomical levels because it's very unlikely the fundamentals will do that for you.

All that to say, my belief is that if you're highly diversified you don't have to worry too much about this. The timing is impossible. I would just caution investors that believe we should pile into 100% US right now simply because of narratives and recency bias. Things can change quickly.