SF2004 said:

EliteZags said:

4x but started relatively low

I'd guess most on here have been investing >20/30% for a while, those that didn't throw away money into bonds/international/target date funds got serous compounded gains past decade and a half

20-30%... yeah maybe if mommy and daddy paid for A&M.

Or is it going to be you paid for a $100,000 education (if you are 40 that is what it cost) while working at dairy queen part time, making a 4.0, and being a hit with the ladies all at the same time in college.

Or is it you got a $100k a year offer in 2006 when you graduated and had nil negative effects of the '08 crisis.

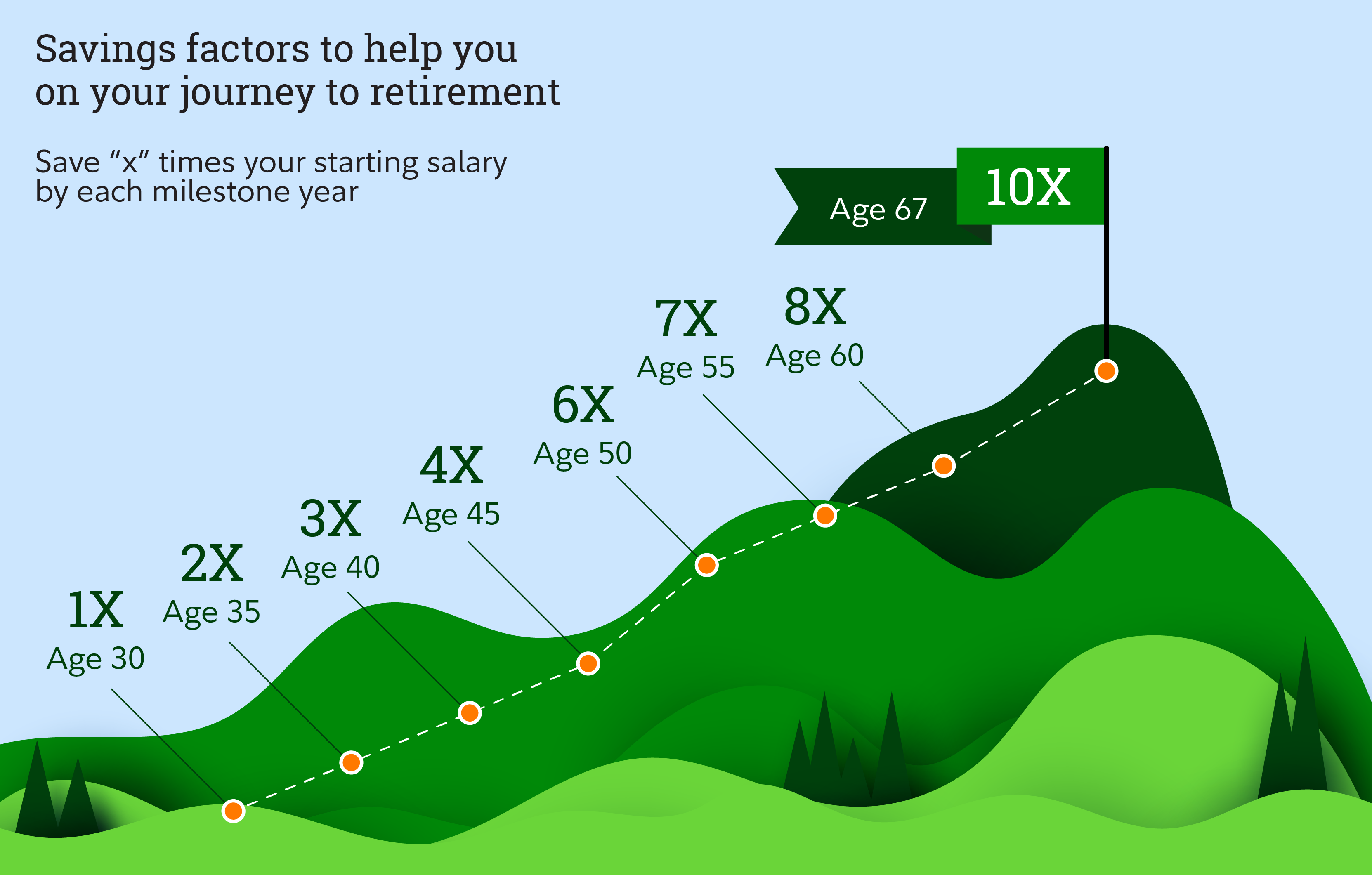

It is simple math and real life. Saying you should have 3x your current salary at 40 is not realistic for most people. It is just fear mongering and pushed by the financial firms to get more money locked up in their 401k accounts so they can charge fees.

Saving 20-30% of your income at 23 is very difficult in most major cities.

A&M isn't MIT, not trying to make this about me but I got out with mid five figures in fed loans which I stupidly aggressively paid off in the first couple years with nearly all my savings, absolutely should have drawn out the low interest rate and invested heavily which would be worth an extra couple years salary now

rent in CS was under $500, covered that with easy part time jobs playing with kids

again I think type of people like in this thread that are financially savvy have easily been investing 20%+ since making six figures

retiring early has been my goal for a while so I've been close to 50% for a while living in a HCOL beach city

just looking at 'simple math' only investing $1K/month (barely half of 401K max) compounding for 18 years at 8%(market has been much better for 40 year olds) gets you close to half a mil