TTUArmy said:Red Pear Realty said:

Silver hit $32 and gold $2,360.

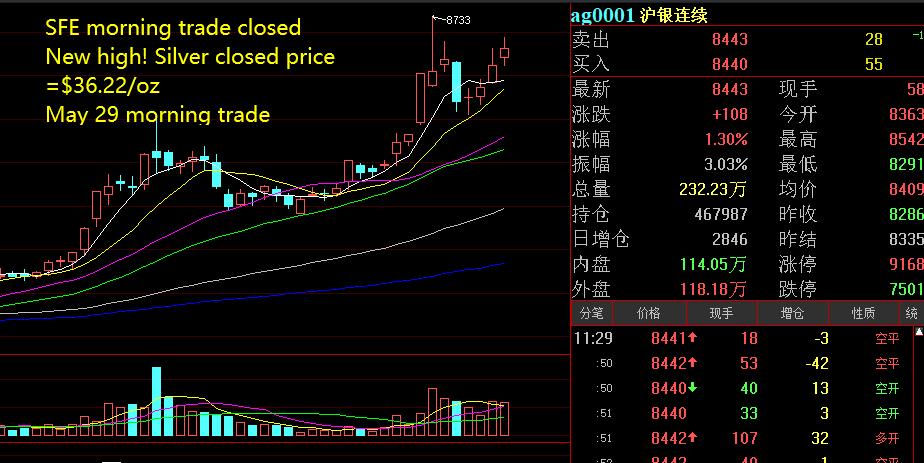

Shanghai market has silver at almost $36 p/troy oz. Pretty wild.

Up, Up, and Away.

Sponsor Message: We Split Commissions. Full Service Agents in Austin, Bryan-College Station, Dallas-Fort Worth, Houston and San Antonio. Red Pear Realty