how bout $1M physical paper cash only

millionaires

768,481 Views |

3046 Replies |

Last: 2 hrs ago by tejas_ayanem

EliteZags said:

how bout $1M physical paper cash only

I like it.

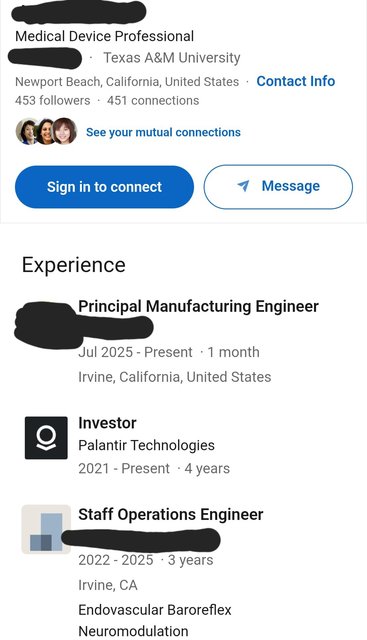

started my final day job and this is how much IDGAF

EliteZags said:

how bout $1M physical paper cash only

Ok buy only US dollars. None of that federal reserve notes

and it's a D-measuring contest!

stonksock said:

Lots of Zillow millionaires getting feisty up in here

LOL. There is just too much emotion in consumer real estate.

EliteZags said:

how bout $1M physical paper cash only

Only if buried in a hidden location marked by a treasure map to be given to your kids at the reading of the will.

GeorgiAg said:Aggie71013 said:

I think the crux is having a $1MM net worth with 100% being home equity is materially different than having $1MM net worth with 30% being home equity.

Yes, net worth is assets minus liabilities, but no those two hypothetical people aren't in the same financial position nor making the same financial decisions.

Absolutely. I don't really consider a home to be in net worth, because if you sell it, what are you going to do? Live in a tent under an overpass?

You have to buy another home or rent

And???

You sell a house and pocket $1m and then go rent a place, and you don't call that money in your hands or part of your worth?

You could sell for $1m and do one of many things;

Take out a heloc and buy investment properties or start a business.

Downsize

Move in with kids.

Rent and have $1m to invest or do whatever with.

Not buy and travel continuously for a while. (my aunt/uncle did this.. sold their house in vail of 20 years, traveled extensively and had no address for like 9 months or something, then bought a house in denver cash plus plenty left over)

Buy a motor home to travel with plenty left over.

Buy another same priced house, assume a mortgage and have $1m less down payment to do something with

Not sure why you wouldn't include this. It is money, it is real, and you can access if you need it, whether retired or not.

Quote:

and it's unlikely you will sell it, cash out the equity and move into substantially less expensive home.

Why is this unlikely?

Seems very likely for retirees.

My parents did it ($1.3m-ish to $850k-ish)

and my dad's sister and uncle did it (~$2m-ish to $750k-ish)

For some reason some people don't think that $450k for my parents or $1.25m for my aunt/uncle is 'real' lol.

'but you have to live somewhere'

62strat said:Quote:

and it's unlikely you will sell it, cash out the equity and move into substantially less expensive home.

Why is this unlikely?

Seems very likely for retirees.

My parents did it ($1.3m-ish to $850k-ish)

and my dad's sister and uncle did it (~$2m-ish to $750k-ish)

For some reason some people don't think that $450k for my parents or $1.25m for my aunt/uncle is 'real' lol.

'but you have to live somewhere'

I will be doing this next year. Home value is around 600K, 400K in equity that I will pay cash for something smaller.

62strat said:Quote:

and it's unlikely you will sell it, cash out the equity and move into substantially less expensive home.

Why is this unlikely?

Seems very likely for retirees.

My parents did it ($1.3m-ish to $850k-ish)

and my dad's sister and uncle did it (~$2m-ish to $750k-ish)

For some reason some people don't think that $450k for my parents or $1.25m for my aunt/uncle is 'real' lol.

'but you have to live somewhere'

agree,,,I have almost a million in equity...and you better know that I'll be cashing in on a huge chunk of that when we downsize after the 4 kids leave...maybe not all of it, but a lot of it...

Much comes down to semantics and how the importance of the term has changed over time.

Just some googling/AI-ing shows:

In 2010 there were ~7-8 million American households that had a net worth of $1MM or more.

In 2020 there were ~22-23 million American households that had a net worth of $1MM or more.

So the literal $ cutoff is no longer near as exclusive a club.

And especially now with home prices what they are, whether or not one includes it in their net worth calculation is due in large to the semantics of it. Sure, you are a millionaire if you have a $700k house, $200k in your 401K and $100k in your bank account.

But that's not viewed the same as someone who is $1MM liquid. Or even $1MM outside of their residence.

It's like saying you play professional baseball when you play on some Frontier league team and not the MLB.

Just some googling/AI-ing shows:

In 2010 there were ~7-8 million American households that had a net worth of $1MM or more.

In 2020 there were ~22-23 million American households that had a net worth of $1MM or more.

So the literal $ cutoff is no longer near as exclusive a club.

And especially now with home prices what they are, whether or not one includes it in their net worth calculation is due in large to the semantics of it. Sure, you are a millionaire if you have a $700k house, $200k in your 401K and $100k in your bank account.

But that's not viewed the same as someone who is $1MM liquid. Or even $1MM outside of their residence.

It's like saying you play professional baseball when you play on some Frontier league team and not the MLB.

EnronAg said:62strat said:Quote:

and it's unlikely you will sell it, cash out the equity and move into substantially less expensive home.

Why is this unlikely?

Seems very likely for retirees.

My parents did it ($1.3m-ish to $850k-ish)

and my dad's sister and uncle did it (~$2m-ish to $750k-ish)

For some reason some people don't think that $450k for my parents or $1.25m for my aunt/uncle is 'real' lol.

'but you have to live somewhere'

agree,,,I have almost a million in equity...and you better know that I'll be cashing in on a huge chunk of that when we downsize after the 4 kids leave...maybe not all of it, but a lot of it...

especially if you're going to a cheaper state to retire.

Lotta places cheaper to live than southern burbs of denver where I'm at now.

Proposition Joe said:

Sure, you are a millionaire if you have a $700k house, $200k in your 401K and $100k in your bank account.

But that's not viewed the same as someone who is $1MM liquid. Or even $1MM outside of their residence.

Why is it not viewed the same?

It is to me.. well other than the 401k which can't be accessed without large penalty until retirement age (but if you die, someone gets the money). But the house equity is easily accessed.. selling or borrowing against.

The thread isn't talking about spending or living like a 'millionaire'.. which you can't do if you're 35 and you have $1mm in 401k, but you certainly can if you have $1m in your checking.

The conversation is about hitting the $1m net worth mark. Both guys in your example have it (assuming that $700k house is paid off)

this thread has gone off the rails

62strat said:Proposition Joe said:

Sure, you are a millionaire if you have a $700k house, $200k in your 401K and $100k in your bank account.

But that's not viewed the same as someone who is $1MM liquid. Or even $1MM outside of their residence.

Why is it not viewed the same?

It is to me.. well other than the 401k which can't be accessed without large penalty until retirement age. But the house equity is easily accessed.. selling or borrowing against.

I agree with you generally (home equity is CLEARLY part of your net worth), but specifically, it is with a group of assets that can be valued gross or net. Examples:

- Gold Bullion - gross is the posted value that dealers will sell for, while net is often 10% or so lower.

- Homestead - gross is what's indicated on an appraisal or a Zillow-type tool, net removes commissions, fix-up expenses, carrying costs during sales process, closing costs, dual living expenses (if you've already moved), and other transactional/frictional costs. I'd say in today's market, I'd estimate net is 10-15% lower than gross, maybe more.

- Investment real estate - similar to homesteads, but likely even worse.

- Small businesses - depending on size, a significant haircut can be expected

- Private equity / private credit, etc. - Redemption fees, exit timeframe restrictions, etc. can really impact your net proceeds

- Inheritance - May involve ongoing probate expenses, taxes, etc.

- Furniture, artwork, boats, planes, vehicles, etc. - expect significant reductions from "market value" when disposing of them

Bottom line, I prefer to look at net worth from a net (liquidation value) perspective, to ensure you're not fooling yourselves on what you're really worth.

I bleed maroon said:62strat said:Proposition Joe said:

Sure, you are a millionaire if you have a $700k house, $200k in your 401K and $100k in your bank account.

But that's not viewed the same as someone who is $1MM liquid. Or even $1MM outside of their residence.

Why is it not viewed the same?

It is to me.. well other than the 401k which can't be accessed without large penalty until retirement age. But the house equity is easily accessed.. selling or borrowing against.

Bottom line, I prefer to look at net worth from a net (liquidation value) perspective, to ensure you're not fooling yourselves on what you're really worth.

Sure.. but then you're taking out taxes of 401ks, taking out 10% of 401k if under 55 for early withdrawal.. etc.

That's way too specific, and it's also a moving target as penalties and taxes can change.

My parents didn't even list their house.. not sure what selling costs were, but def not 10-15%. Not even close.

62strat said:I bleed maroon said:

Bottom line, I prefer to look at net worth from a net (liquidation value) perspective, to ensure you're not fooling yourselves on what you're really worth.

Sure.. but then you're taking out taxes of 401ks, taking out 10% of 401k if under 55 for early withdrawal.. etc.

That's way too specific, and it's also a moving target as penalties and taxes can change.

My parents didn't even list their house.. not sure what selling costs were, but def not 10-15%. Not even close.

Congrats to them - they're not typical. Between 6% commission, 1-2% closing costs, 1-2% fix up expenses, 2-5% carrying cost / dual living expenses, plus capital gains tax (if relevant), there are plenty of people who are more than "even close" to my 10-15% range.

I bleed maroon said:62strat said:I bleed maroon said:

Bottom line, I prefer to look at net worth from a net (liquidation value) perspective, to ensure you're not fooling yourselves on what you're really worth.

Sure.. but then you're taking out taxes of 401ks, taking out 10% of 401k if under 55 for early withdrawal.. etc.

That's way too specific, and it's also a moving target as penalties and taxes can change.

My parents didn't even list their house.. not sure what selling costs were, but def not 10-15%. Not even close.

Congrats to them - they're not typical. Between 6% commission, 1-2% closing costs, 1-2% fix up expenses, 2-5% carrying cost / dual living expenses, plus capital gains tax (if relevant), there are plenty of people who are more than "even close" to my 10-15% range.

But how do you know any of this until you sell? You don't... you don't even know the value/selling price to begin with.

So why bother taking situational/arbitrary percentages out of a number that's arbitary-ish to begin with?

My house is worth about $x based on comps, and I owe y. So my net value is x-y. Simple as that, put it on the spreadsheet.

62strat said:

But how do you know any of this until you sell? You don't... you don't even know the value/selling price to begin with.

So why bother taking situational/arbitrary percentages out of a number that's arbitary-ish to begin with?

My house is worth about $x based on comps, and I owe y. So my net value is x-y. Simple as that, put it on the spreadsheet.

For the sake of argument, most net worth is arbitrary... stock market could crater tomorrow and blow up 401k's... For travel people, the value of the dollar overseas has been plummeted so overseas travel has become more expensive. If you have buckets of cash, they ain't worth as much.

Let's just make this a Deca thread... get rid of all the riff raff and hair splitting.

Ag92NGranbury said:62strat said:

But how do you know any of this until you sell? You don't... you don't even know the value/selling price to begin with.

So why bother taking situational/arbitrary percentages out of a number that's arbitary-ish to begin with?

My house is worth about $x based on comps, and I owe y. So my net value is x-y. Simple as that, put it on the spreadsheet.

For the sake of argument, most net worth is arbitrary... stock market could crater tomorrow and blow up 401k's...

agreed, but I can sell all my stock right now and know exactly what I'm getting.. so not really arbitrary at all.

Can't say that about a house. So I don't see the point in coming up with some imaginary 'net' net worth vs 'gross' net worth.

That is taking this metric beyond the spirit of what it is.

From today's WSJ. Relevant to this thread.

and then there's this social acquaintance hopping from his 23M Newport Coast mansion to his 25M Venetian Islands waterfront estate on his G450 giving his aspiring artist buddy a ride between LA/Miami shows

You know that dude?

been to a few parties at his place and modest yacht before it sadly moved to park in front of Miami house

I haven't started up my billionaire thread yet. Maybe you are first invitee?

still trying to max megabackdoor roth and yolo it into tech

I have a friend who recently got a jet.

And since he has a jet that enabled him to get a ranch in Durango.

He and his family go someplace about once a month. Besides the ranch they also frequent Napa and the Caymans.

And since he has a jet that enabled him to get a ranch in Durango.

He and his family go someplace about once a month. Besides the ranch they also frequent Napa and the Caymans.

bagger05 said:

I have a friend who recently got a jet.

And since he has a jet that enabled him to get a ranch in Durango.

He and his family go someplace about once a month. Besides the ranch they also frequent Napa and the Caymans.

if only there were direct flights to Durango from major Texas cities.

I certainly don't have that kind of money but I get it.

Looking only at the to door time for him if he's flying commercial vs private he is turning a probably 7 or 8 hour trip into a 2.5 hour trip. And that's assuming you get the connecting flights to time out perfectly. He lives in a place where he would need to fly to probably DFW or Denver to get to Durango so two legs.

And that's not considering that you're avoiding the hassles and BS of commercial air travel. Plus you can take guests whenever you want. And the positive ego effects of getting to go there in your private jet.

That's still a high price to pay for saving some time, but I think for him the reality is that if going to the ranch meant spending almost a full day getting there it was just going to be too much of a hassle to go.

And for all of us the definition of "expensive" changes a lot as we get more money.

Looking only at the to door time for him if he's flying commercial vs private he is turning a probably 7 or 8 hour trip into a 2.5 hour trip. And that's assuming you get the connecting flights to time out perfectly. He lives in a place where he would need to fly to probably DFW or Denver to get to Durango so two legs.

And that's not considering that you're avoiding the hassles and BS of commercial air travel. Plus you can take guests whenever you want. And the positive ego effects of getting to go there in your private jet.

That's still a high price to pay for saving some time, but I think for him the reality is that if going to the ranch meant spending almost a full day getting there it was just going to be too much of a hassle to go.

And for all of us the definition of "expensive" changes a lot as we get more money.

No doubt. Was just busting your balls about the "enabled" comment.

It's not like Durango is a super remote destination.

I have flown private all of once, and the convenience factor was awesome.

It's not like Durango is a super remote destination.

I have flown private all of once, and the convenience factor was awesome.

private is a completely different game.Diggity said:bagger05 said:

I have a friend who recently got a jet.

And since he has a jet that enabled him to get a ranch in Durango.

He and his family go someplace about once a month. Besides the ranch they also frequent Napa and the Caymans.

if only there were direct flights to Durango from major Texas cities.

I've been on a citation X 3 times out of San, apa, and mke… even going into a big airport like San, you're in the non security executive area, so a totally different ballgame.

Any of you guys hit the millionaire mark primarily based on one big bet on a single stock/crypto like NVDA or Bitcoin?

I hit the millionaire mark last year with the majority of my money in index funds, and looking to be a little more risky with future contributions. Ive been adding to RGTI and TSLA on the dips. Of course, everytime Ive tried to bet on riskier stocks in the past I always lose money, probably a sign just to stick with index funds lol.

I hit the millionaire mark last year with the majority of my money in index funds, and looking to be a little more risky with future contributions. Ive been adding to RGTI and TSLA on the dips. Of course, everytime Ive tried to bet on riskier stocks in the past I always lose money, probably a sign just to stick with index funds lol.

Diggity said:

No doubt. Was just busting your balls about the "enabled" comment.

It's not like Durango is a super remote destination.

I have flown private all of once, and the convenience factor was awesome.

I gotcha. "Enabled" might not be the right word. But if I had private jet money I bed my definition of what was possible or practical would shift dramatically.

Texag5324 said:

Any of you guys hit the millionaire mark primarily based on one big bet on a single stock/crypto like NVDA or Bitcoin?

I hit the millionaire mark last year with the majority of my money in index funds, and looking to be a little more risky with future contributions. Ive been adding to RGTI and TSLA on the dips. Of course, everytime Ive tried to bet on riskier stocks in the past I always lose money, probably a sign just to stick with index funds lol.

So, you want to fix what isn't broken?

Featured Stories

See All

12:32

18m ago

177

8:13

3h ago

406

Ali Dibba finding success as a 3-point shooter for McMillan & Co.

by Luke Evangelist

21:20

16h ago

3.7k

Lack of height bites A&M in 86-85 loss to Mizzou

by Olin Buchanan

17:50

6h ago

2.5k

Colonel Ingus

The Vol's [renovated] baseball stadium is complete.

in Billy Liucci's TexAgs Premium

82

Kendall Rogers

The Vol's [renovated] baseball stadium is complete.

in Billy Liucci's TexAgs Premium

31

Kendall Rogers

The Vol's [renovated] baseball stadium is complete.

in Billy Liucci's TexAgs Premium

20